This post is an exploration of the idea of capped returns which we’ve been talking about and experimenting with in some of our Enspiral businesses for the past few years.

Loomio has just completed the first significant capped return investment with external investors using redeemable preference shares and Enspiral Dev Academy is in the process of following suit.

It has a relatively long preamble so feel free to jump straight to the details of capped returns.

The problem: Money is eating the world

I love business. It has been a driving force for progress and the source of much to be grateful for. But our current model of capitalism is voracious and knows no bounds.

Capitalism was useful for a time but it is now maladapted to our current environment and we need a better system.

The current economy must grow to survive

The gravitational pull of our financial system is toward growth. Success is not defined by making profits, but by growing the size of those profits over time.

Imagine you run an investment fund, looking after people’s retirement savings. You naturally want to do the best you can for your clients and and earn bonuses. Say you have two investment opportunities – one which is profitable but static and one which is profitable and growing. If both are equally risky, which do you choose?

Now imagine you are running a publicly traded company which is profitable but steady, and there is someone who wants your job and has a plan to grow the company’s profits. Who do you think the directors and shareholders will choose?

This is a very simplistic view of a complex system, but it highlights one of the maxims of our business world: failure to grow is failure, full stop. At the level of an individual company or investor this makes a lot of sense, but at a systemic level it is an awful idea.

Weevils, Cancer and Tyrants

These metaphors may seem overly harsh but I think they highlight some of the core reasons why our current financial systems aren’t working for us.

When you can’t see the barrel for the flour

If you put a few weevils in a barrel of flour and seal the lid they will eat, shit, and reproduce. The population will grow exponentially until the flour is gone, and all that will be left is a barrel of dead weevils and crap. This is the logical conclusion of exponential growth in a closed system.

This isn’t because weevils are evil or have a bad design – it’s just that they evolved in a different context, where there is always another barrel of flour to find and no attempt is made to maintain a steady population in the same place. In the wild, by the time the weevil’s ancestors return to the original barrel other organisms have had time to turn the shit back into flour.

Similarly, our financial system evolved in a different context to the world today. As a framework it is only a few hundred years old. It was the 1800s when the modern corporate form started to resolve. The human presence on the planet was much sparser and we were so deep in the flour we couldn’t see the barrel.

It isn’t surprising that the system normalised limitless growth.

Going Rogue, the natural way

One characteristic of the natural world is that while organisms often compete with each other they nearly always act in ways which support the health of the whole. Those natural experiments which were detrimental to the whole were mostly selected out as evolution stumbled upon a realisation that became encoded into our collective genetic intelligence, “Oops, crashed the ecosystem. Better not do that again“.

When you’re working on a timeline of billions of years that’s a fine strategy. But for a small bunch of humans running experiments over centuries, a considered approach might be more appropriate. Luckily, we can learn a lot from these natural experiments and I think the story of cancer is instructive.

A multicellular organism is a carefully choreographed dance between trillions of cells (roughly 1 trillion cells per kilogram in a human). Cells grow, reproduce and die.

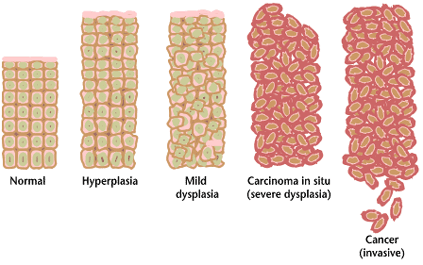

When the DNA of a cell gets messed up, it can go rogue and start doing its own thing. In certain configurations of rogueness we call this cancer. It sucks.

There are a few patterns in cancer pathophysiology which are enlightening for the current topic:

- Cells which mutate to reproduce much faster than normal and start outpacing other cells in the organism

- Cells which start reproducing when the body doesn’t tell them to (self sustaining growth signals)

- Cells which ignore anti-growth signals

- Cells which ignore the signal to die (apoptosis signalling pathway) and effectively become immortal

- Cells which grow where they aren’t meant to (metastasis)

This rebellion-like scenario becomes an undesirable survival of the fittest, where the driving forces of evolution work against the body’s design and enforcement of order. Wikipedia: Cancer

(emphasis mine)

A common trend in all these scenarios is that the cell’s health is at odds with the health of the whole organism. There are a few take-aways for an analysis of our financial system:

- When companies are hooked on growth they will take individual action that is harmful for society as a whole.

- The system of capitalism has been incredibly successful and as a system it is growing and improving faster than other systems in our society, particularly our political ones.

When killing the tyrant isn’t an option

There is a big difference between capitalism and cancer though: it is not just a few rogue businesses causing problems that we can try to remove. The whole system behaves like cancer and, while harmful, serves an incredibly useful function in society with many positive side effects.

In this way our financial system is more like a tyrannical general who does something useful like protecting the population, but enslaves the population in the process. Being enslaved kind of sucks, but just killing the tyrant isn’t much of an option.

The traditional approach to manage this dynamic has been to put constraints around business activity through regulation and to balance commerce with government. Instead of just a tyrant, we also have a queen who keeps the general in check and occupied on useful things.

In our world the queen’s power has been waning as the general’s rises. Over time, the constraints on business have been removed in the quest for bigger armies, wealth, and power. Instead of the general serving the population, it sometimes feels like the population exists to serve the general. That’s messed up.

In short, business has become so good at growing that it has deeply corrupted our governments and media. It has weakened the critical constraints on growth, and our planet is starting to look like a barrel of flour full of weevils, headed for collapse.

The Solution: steady state economics

There are two paths in front of us – option A is to transition to a steady state system where the amount of total growth is (at least) balanced by the amount of total contraction. Option B is to collapse, when a system which can only function by growing hits the limits of a finite planet.

Option B lacks appeal so let’s not dwell on that too much. Let’s explore option A.

Here are some design constraints I’ve been exploring for possible solutions to help migrate to a steady state economic system.

- No (initial) dramatic regulation changes – our political systems are too deeply captured

- Cheap to start and experiment with

- Easy to copy and improve

- Provide better options for investors and businesses than the current system (else why would they switch)

- Serve the commons – the current system can’t co-opt the good bits of the idea and keep working at odds with the health of the whole

Those constraints are kind of daunting, but I have found them useful to focus my thinking. In particular there has been a lot of work done by people looking at the fundamentals of our monetary system as the root cause of growth addiction. I think the theory is sound but the experiments or proposed solutions I’ve seen always fail one of the constraints.

The ideas below are not a comprehensive solution by any means, I think they show promise and are worth sharing as early stage prototypes needing a lot more work.

The Idea: capped returns

It’s pretty simple – Whenever investors or entrepreneurs receive equity in a business the total returns on the equity are capped. The returns should be fair but they do not result in a perpetual claim on the profits of the venture.

The implementation is pretty simple as well. Whenever a company issues shares, it writes a matching call option where it is required to repurchase the shares at an agreed upon price.

Sounds like crazy talk, right? Why would anyone do this kind of deal, and why would it matter if they did?

What happens when all the shares are repurchased?

A big party!

In this model a company has two types of shares – financial shares which yield returns until they are repurchased, and governance shares which only have voting rights and do not expire. This is pretty simple to set up in a company constitution.

When the financial shares are gone all that is left are the governance shares and now 100% of the profits from the venture are available for the organisation’s social mission. These profits are controlled by the (governance) shareholders through the company directors.

Without the financiers’ boot on their necks, the directors are now free to be much more creative with how they spend profits. They could invest in making their company the best possible place to work, or fund ambitious social impact projects, or invest significantly in the commons.

The company still needs strong governance and checks and balances to prevent things like inflated salaries or inefficient operations, but these are solvable through mechanisms other than owners optimising for profit.

How is this better for investors?

Capped returns aren’t better for all deals or investors, but they will be for some.

If you are trying to maximise financial returns, then a perpetual claim on profits is better than a capped return. You would only take the capped return if no other options were available.

This investment structure will open up deals for businesses which weren’t fundable before — good businesses with great financial prospects that could generate healthy returns but would never raise traditional equity.

Some of these businesses are launching in developing economies where liquidity options such as an Initial Public Offering or acquisition aren’t possible. Others are early stage ventures which aren’t shiny enough to return a Venture Capital fund in one go, so miss out on angel funding.

Others are impact driven businesses with no interest in being acquired or maximising the dividends they pay to shareholders. They exist to change the world through achieving their social mission.

Capped return investments can also dramatically change the risk profile of investing in an early stage business by agreeing on payment terms that are a share of revenue and look more like a capped royalty than traditional equity.

In short, these types of deals can be better for investors by opening up deal flows that were inaccessible before, and by changing the risk profile of early stage ventures. For investors who want to keep the social mission at the fore or invest in the commons, it is a much better model.

Why would an entrepreneur care?

Starting a company is not a rational act. It is an act of unreasonable conviction and passion, a belief that you can see something that few other people can, and that your vision is true. The art of entrepreneurship is balancing this unreasonable conviction with the humility to listen to the world and adapt accordingly.

Founders are deeply attached to the businesses they create. Many realise that they aren’t the people to lead the business over its whole lifecycle but they still care about what happens after they step away. They care about the people, the customers, and the mission.

Capped returns are a way of preserving that which is most dear while still accessing capital and receiving fair compensation for the sacrifice and value creation of launching a successful business.

Financial incentives matter, but with adequate access to capital to fund the next venture it really doesn’t matter if an entrepreneur makes 1 million or 100 million.

When I first started Enspiral I made a clear decision to give the whole thing away – to generate opportunities instead of money. It worked. I am now flooded with opportunities, and in a similar financial position to when I started. I’m very glad that I structured things that way, but as an entrepreneur it isn’t the sort of deal I would do over and over again.

When setting up Dev Academy my co-founder and I agreed on capped returns for ourselves and our investors. Time will tell how it plays out, but from my point of view it feels like a good balance between giving everything away and fair compensation.

How does this link back to steady state economics?

The biggest problem with our current system is that the growth path of successful companies very often end up with an IPO or acquisition by a listed company. No matter where they start, companies tend to end up in a profit maximising system with incentives to externalise as many costs as they can onto society. In this model, a few win while society loses.

The shares in those public companies never expire. They transition from being a vehicle for fair compensation to investors and entrepreneurs to becoming licenses to extract wealth from society that are sold to the highest bidder. There are dividends being paid out today on shares in companies where every person who took the risks and put in the capital to start it up has been dead for 100 years. The returns have become divorced from their original connection to meaningful inputs to the business.

If capped returns became the norm of business then the growth path of a successful enterprise would be to pay back its founders and investors early on in its lifecycle (first decade or two). Then there would be a big celebration as the business became a freehold impact venture with a binding mandate to serve wider society.

There would still be motivations to grow, but they would be far less than our current system. We would increase the net amount of energy going towards the commons and positive social impact.

We could make a decent dent in financial inequality, as investors would need to work harder to find new deals for their upcycled capital instead of passively living off ‘financial extraction licenses’. This post on the founding story of Ford has more thoughts on the relationship between perpetual returns and inequality.

Reaching Scale

**Warning, speculative thinking ahead**

Building a small ecosystem of capped returns is all well and good, but it won’t make much of a difference in the grand scheme of things. This idea has the most potential for impact if it becomes the new norm and displaces indefinite returns significantly – maybe entirely.

To do this, it would need to move from niche ecosystem to wide spread movement, similar to the alliances around climate change and other major social movements.

It would be easy to create a mechanism where a company’s constitution mandates that its surplus is either spent on the social mission or reinvested in capped return vehicles, similar to how the GPL locks IP into the public sphere. This would create an ecosystem of capital legally bound to a capped returns social impact model – a self-reinforcing engine of positive change.

Add in a commitment to transparency, like Buffer’s transparency dashboard, some basic workplace democracy, and a simple brand like Fairtrade, and you have the basis of a low-cost network uniting investors, entrepreneurs, staff, and consumers to out co-operate traditional business.

Combined with a sustained political movement to plug the costs externalised by businesses (a long battle in its own right), this would create a playing field where the capped returns business ecosystem has a the following sustainable advantages:

- cheaper capital – capped returns fundamentally lowers the value of capital which means that it is a better deal for businesses needing investment. The compounding capital in the ‘once in, never out’ ecosystem can handle the supply side and make capitalism more efficient.

- a stronger social contract – because the ecosystem is contributing to the health of the whole rather than destroying it

It would also be possible to play with other dynamics such as procurement policies weighted towards capped returns suppliers, or IP which is put into the commons but only accessible to companies in the capped returns ecosystem. Combined, all of these could create an economic ecosystem which is more effective and efficient than the current one. The good thing about business is that when you are better, you usually win.

At its core, reaching scale would be about building a broad-based movement around the immorality of an extractive economy, and demonstrating a viable alternative that people could participate in. The new economy could out compete the current one and would eventually displace ‘anti-social enterprise’.

The Inspiration

I first bumped into parts of this idea in 2012, in a blog post on revenue share royalties as an investment model in developing economies (which I’ve never been able to find again, please share if you can).

This prompted me to start hacking on some internal experiments with Enspiral folks which I called Fairy Gold. Since then this approach has influenced how I’ve been structuring deals, particularly Dev Academy.

In 2013, there were some panels at SOCAP talking about Demand Dividends, which are royalty-based financing with a cap. I also bumped into Luni from fledge who was doing capped returns as part of his impact accelerator.

Indie.vc made a splash in early 2015 when they launched a fund with capped returns (conditional on the founders not selling out), and I’d encourage you to checkout Bryce Robert’s thinking on the topic, which is quite different to mine: here, here, here and here.

Sacred Economics and the New Capitalist Manifesto have been pretty influential in my thinking and I highly recommend them.

What Next?

There are a lot of “ifs” in this post, and the idea needs refining and experimentation. The lifecycles we are talking about are relatively long, and it would take many people from different backgrounds collaborating over decades to see if this could work.

But the opportunity is huge. Our economy is one of the most powerful systems in human society, and it is currently causing a lot of damage. If we can shift the fundamentals of our economic system from extractive to generative, it would be difficult to overstate the impact we’d have on our world.

I am up for more experiments. The only deals I’m considering anymore are ones where the returns are capped. I would love to collaborate with anyone else who is exploring this space.